Motor

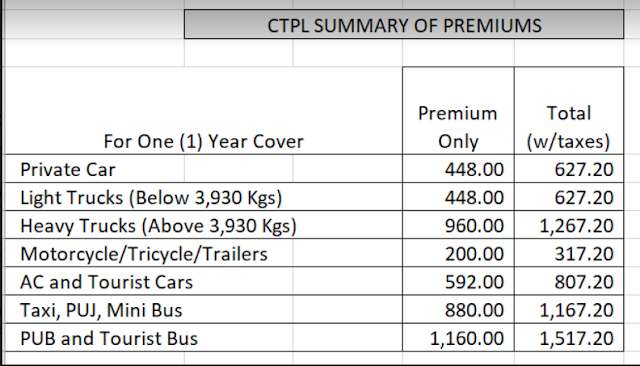

In the Philippines, motor insurance is not just a wise choice, it’s a legal necessity. Every registered vehicle must have at least basic Compulsory Third Party Liability (CTPL) insurance. This safeguards you from liabilities to third parties in case of accidents involving bodily injuries or death. However, the risks of not having comprehensive coverage are significant. Without it, you’re financially exposed to the costs of repairs, theft, and natural disasters. Accidents can happen anytime, and the financial burden of repair and medical bills can be overwhelming. Protect your vehicle and your wallet; ensure you’re fully covered with the right motor insurance policy in the Philippines. 🚗💼 Source of Information

Contact us and Get a Free Quote

Email: rossbethel.propertyinsure@gmail.com

Mobile: +0936 188 7653

Sponsored Link:

A blog that covers the latest news, research, and innovations in plant-based stem cell therapy and how it can benefit your health and wellness.

Just Follow The Link: Green Apple Stem Cell Therapy

.jpeg)

Comments

Post a Comment